Everything you need to Know about Health Insurance

Healthinsurance is an important and often confusing purchase for you and everyone in

your family. The first step in understanding that health insurance is knowing

where to get coverage, figuring out the different types of plans, seeing what's

covered, and defining the industry terms. Once you have that information,

you'll have the information to make an informed decision about the right health

plan for you.

What is private health insurance?

Private

health insurance is a product that can help cover your healthcare costs.

Depending on the type of cover you take out, a health insurance policy can help

pay for your treatment as a private patient in a hospital or treatment outside

of hospitals.Moreover, combined health insurance policies cover both hospital

and general treatment costs.

However, sometimes

there may be restrictions on what you can and cannot claim. For instance,

certain treatments require that you first sit through a waiting period. By

making you wait several months before you can claim, the health fund can be

sure that you’re not just joining up to take advantage of subsidized treatment

before cancelling. This kind of behavior would increase the cost of health

insurance for everyone, which is why waiting periods must be observed for many

types of treatments.

Where can you get coverage?

In the US,

all health coverage options fall into one of two general categories. You can

obtain individual coverage for yourself and your family by reaching

out to insurers directly, or receive group coverage as an eligible

employee or student. With the arrival of the Affordable Care Act, the

parameters and regulations pertaining to both types of coverage have been

altered significantly.

Individual

Coverage: The costs and availability of individual coverage were highly

variable. Thanks to the ACA, individual health insurance plans must now cover

you regardless of preexisting conditions or health problems. Under this type of

coverage, policyholders are allowed to choose their own physicians. You can

choose three coverage pathways:

●Providers within the ACA healthcare

exchange

●Providers outside the ACA

healthcare exchange

●Policies that provide short-term

coverage

How much does health insurance cost?

Your health

insurance premium – the amount you pay monthly or yearly to maintain cover

– is affected by a range of factors, including:

●The excess you choose to pay in the

event of a claim

●The product and insurer you chose

●Your level of cover

●How many people your insurance

policy covers

What coverage is provided in every health insurance

plan?

As part of

the ACA, all health insurance plans must cover "essential health

benefits." These covered benefits include:

●Outpatient care

●Emergency care

●Hospitalization

●Pregnancy and newborn care

●Mental health and substance abuse

services

●Prescription drugs

●Rehabilitation services

●Preventive and wellness services

●Dental and vision care for children

Ideally,

your plan enables you to receive medical treatment whenever needed. Some

insurers cap your annual number of primary care visits, while others are more

lenient and allow you to schedule as many appointments as you think are

necessary. Before enrolling in a new plan, it’s crucial to establish if there

are any restrictions regarding primary care visits and, if so, exactly how many

physician visits you are allowed.

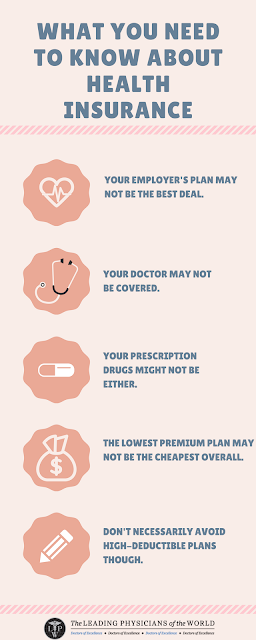

The right

health insurance plan for you depends on many factors, including your financial

situation and health status. When making the decision, you

should review the past few years of your healthcare plan, as well as the

healthcare provided to your family. Also, you should think ahead to the next

year. Think about you and your family's health situation, healthcare use,

prescription drugs, and whether you have expendable income to pay out-of-pocket

costs.

Comments

Post a Comment